Advisers don't think bank turnaround times are where they should be, our Advisers on Banks report reveals

If you’re a bank, turnaround times simply cannot be ignored if you want to deal with advisers.

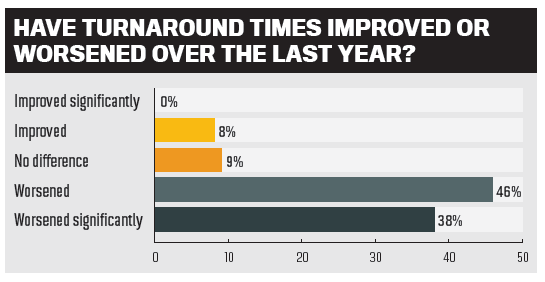

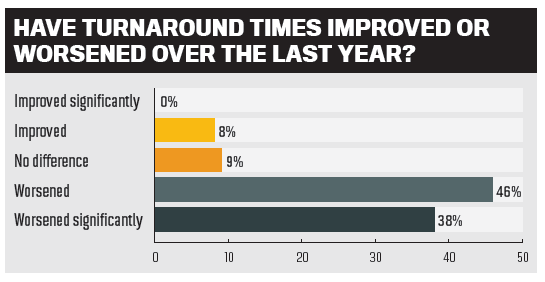

NZ Adviser’s Advisers on Banks report revealed that turnaround times were the biggest concern for advisers, clearly indicating banks have not paid enough attention to this service (46% said turnaround times had worsened), with a further 38% of respondents saying turnaround times had worsened significantly. Nine per cent were indifferent and only 8% said there had been an actual improvement.

Advisers were asked to rate the performance of the banks they had dealt with in the last 12 months against 11 criteria, ranging from turnaround times to product diversification opportunities, with the final rankings based on an average of these category scores. Download the full report to see which banks were ranked highest.

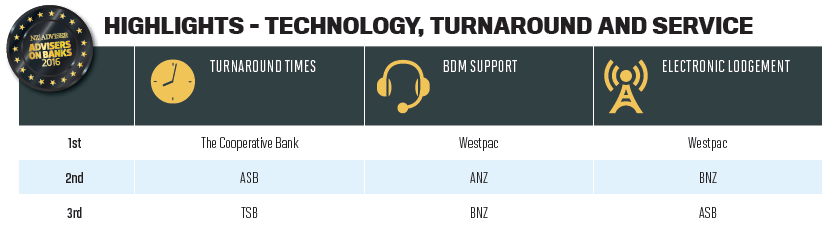

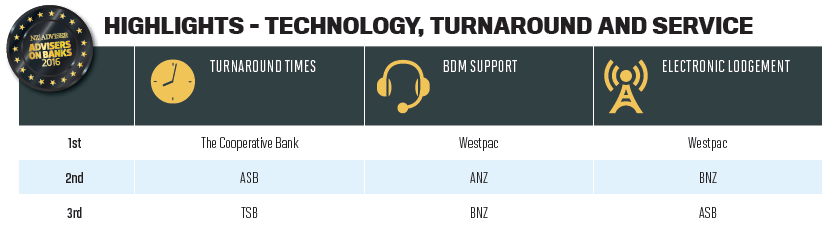

Interestingly, the non-major banks were among the ones excelling in this category with the Cooperative Bank achieving the highest score from advisers and SBS Bank and TSB also performing strongly. ASB's turnaround times were rated highest among the major banks and it came second overall in this category.

We asked advisers whether new technology had improved turnaround times and many said that it hadn’t. “Westpac is the only bank that offers a central repository to upload supporting documents efficiently,” commented one respondent, supporting the bank’s top ranking in the electronic lodgment category.

But another was more optimistic, saying they expect technology upgrades will start to impact turnaround times in the next 12 months, “as CRM platforms and banks start to work together”.

You can read the full report here.

NZ Adviser’s Advisers on Banks report revealed that turnaround times were the biggest concern for advisers, clearly indicating banks have not paid enough attention to this service (46% said turnaround times had worsened), with a further 38% of respondents saying turnaround times had worsened significantly. Nine per cent were indifferent and only 8% said there had been an actual improvement.

Advisers were asked to rate the performance of the banks they had dealt with in the last 12 months against 11 criteria, ranging from turnaround times to product diversification opportunities, with the final rankings based on an average of these category scores. Download the full report to see which banks were ranked highest.

Interestingly, the non-major banks were among the ones excelling in this category with the Cooperative Bank achieving the highest score from advisers and SBS Bank and TSB also performing strongly. ASB's turnaround times were rated highest among the major banks and it came second overall in this category.

We asked advisers whether new technology had improved turnaround times and many said that it hadn’t. “Westpac is the only bank that offers a central repository to upload supporting documents efficiently,” commented one respondent, supporting the bank’s top ranking in the electronic lodgment category.

But another was more optimistic, saying they expect technology upgrades will start to impact turnaround times in the next 12 months, “as CRM platforms and banks start to work together”.

You can read the full report here.