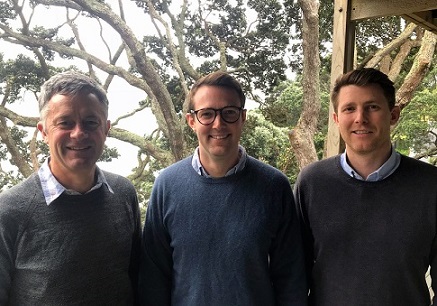

The brothers and TOWER’s former CFO Brett Wilson are set to launch New Zealand first chatbot for the local insurance industry

.jpg)

New insurance company Cove will use a chatbot via Facebook Messenger to connect to its customers and to sell fire and general products through when the service launches next year.

In what is believed to be a New Zealand first, Cove’s bot will cut down application questions by using external databases and “a little bit of AI to guide through the process”, co-Founder Andy Coon told Insurance Business.

Coon, his brother Rob and Brett Wilson, former TOWER CFO, founded the company in Auckland, in January.

Coon said Cove looked to New York insurance start-up Lemonade and other digital fintech providers offerings, which demonstrated how simple and clear customer processes can be, and how quickly they had gained “enormous popularity” from consumers.

When Cove launches it will not rely on the new robo-advice exemption under the Financial Advisers Act (FAA) that the Financial Markets Authority (FMA) granted last month. This is because the bot has been built according to the original reading of the FAA, meaning the bot will not give financial advice.

From left: Brett Wilson (CFO), Andy Coon (CEO), Rob Coon (Head of Product)

“Robo-advice came about while we were building this (bot), and we think it’s great and it gives us some flexibility to do things we hadn’t planned to do initially but it’s not integral to our initial launch plan”.

Coon said bots can simplify the process of purchasing traditionally complex products such as life insurance (although Cove will not sell this at first), and make it a smoother process to navigate without reams of paperwork.

More importantly, bots can seamlessly connect with a range of other technologies, such as facial recognition software, to detect a person’s age and health from a simple selfie.

Internationally, bots in the insurance industry have enabled claims to be paid in as little as three seconds, and policies purchased in just 90 seconds, he added.

Cover Head of Product Rob Coon said: “Initially we are looking at offering insurance products that will be clear and easy to understand, easy to manage, and simple to purchase.

“Early feedback from consumer testing on our next range of insurance products has been extremely positive, and we look forward to introducing them to New Zealanders in 2018.”

As the younger and more technologically adept market continues to grow, the insurance industry has a responsibility to transform its image from a complex, policy focused sector, to one that is more in tune with providing an exceptional user experience for all New Zealanders, Rob Coon added.

Related stories:

Insurance companies accused of keeping prices in the dark

Cyber insurance ‘the Wild West’ without standards

In what is believed to be a New Zealand first, Cove’s bot will cut down application questions by using external databases and “a little bit of AI to guide through the process”, co-Founder Andy Coon told Insurance Business.

Coon, his brother Rob and Brett Wilson, former TOWER CFO, founded the company in Auckland, in January.

Coon said Cove looked to New York insurance start-up Lemonade and other digital fintech providers offerings, which demonstrated how simple and clear customer processes can be, and how quickly they had gained “enormous popularity” from consumers.

When Cove launches it will not rely on the new robo-advice exemption under the Financial Advisers Act (FAA) that the Financial Markets Authority (FMA) granted last month. This is because the bot has been built according to the original reading of the FAA, meaning the bot will not give financial advice.

From left: Brett Wilson (CFO), Andy Coon (CEO), Rob Coon (Head of Product)

“Robo-advice came about while we were building this (bot), and we think it’s great and it gives us some flexibility to do things we hadn’t planned to do initially but it’s not integral to our initial launch plan”.

Coon said bots can simplify the process of purchasing traditionally complex products such as life insurance (although Cove will not sell this at first), and make it a smoother process to navigate without reams of paperwork.

More importantly, bots can seamlessly connect with a range of other technologies, such as facial recognition software, to detect a person’s age and health from a simple selfie.

Internationally, bots in the insurance industry have enabled claims to be paid in as little as three seconds, and policies purchased in just 90 seconds, he added.

Cover Head of Product Rob Coon said: “Initially we are looking at offering insurance products that will be clear and easy to understand, easy to manage, and simple to purchase.

“Early feedback from consumer testing on our next range of insurance products has been extremely positive, and we look forward to introducing them to New Zealanders in 2018.”

As the younger and more technologically adept market continues to grow, the insurance industry has a responsibility to transform its image from a complex, policy focused sector, to one that is more in tune with providing an exceptional user experience for all New Zealanders, Rob Coon added.

Related stories:

Insurance companies accused of keeping prices in the dark

Cyber insurance ‘the Wild West’ without standards