When buying a home in New Zealand, remember to follow these steps

Updated November 16, 2023

New Zealand ranked sixth in the Global Cost of Property report on the least affordable countries worldwide. While there is more than enough space to build new houses in New Zealand, property prices continue to rise year after year.

While this makes New Zealand unaffordable for many average earners, the demand for housing remains high. But it is not hopeless.

In this article, we will explore buying a home in New Zealand. This includes looking at the current housing market, the different steps you need to take when buying a home, and the different benefits available to first-time homebuyers.

Here is everything you need to know about buying a home in New Zealand.

Buying a home in New Zealand: understanding the market

As of September 2023, the median house price in New Zealand was $785,000, according to the latest report from the Real Estate Institute of New Zealand (REINZ). That figure represents a decline of 3.1% from September 2022.

However, there are still plenty of places to buy property in New Zealand.

For New Zealand, excluding Auckland, the median price dropped by 2.1% to $700,000. The total number of homes for sale across the country was 23,564. That represents a decline of 9.0% (or 2,339 properties) from 25,903 year-on-year, and an increase of 3.6% month-on-month.

The median price of a home in Auckland in September 2023 was $1,015,000, down 2.0% compared to September 2022. Marlborough saw the highest increase year-on-year, with a 25.4% bump to $740,000. Taranaki, meanwhile, saw the largest year-on-year drop, of 7.7% to $581,500.

Here is a breakdown of the median house prices per region (versus September 2022), according to REINZ’s September 2023 data.

- Northland: $700,000 (-3.4%)

- Auckland: $1,015,000 (-2.0%)

- Waikato: $745,000 (-3.9%)

- Bay of Plenty: $800,000 (-5.3%)

- Gisborne: $550,000 (-3.7%)

- Hawkes Bay: $700,000 (-1.4%)

- Manawatu/Wanganui: $530,000 (-7.0%)

- Taranaki: $581,500 (-7.7%)

- Wellington: $782,000 (-4.6%)

- Tasman: $810,000 (-5.8%)

- Nelson: $680,000 (-2.7%)

- Marlborough: $740,000 (+25.4%)

- West Coast: $390,000 (+8.3%)

- Canterbury: $680,000 (+0.7%)

- Otago: $661,000 (-0.6%)

- Southland: $450,000 (0.0%)

- New Zealand: $785,000 (-3.1%)

How much money do you need to buy a house in NZ?

When buying a home in New Zealand, there are several considerations you will need to make. The first is the size of the deposit you will be able to afford. Others are how you will save for the deposit and how you will afford your ongoing home loan payments.

While this approach may seem backwards, it is smarter to start with the level of home loan payments you can afford, rather than the type of home you want. To determine what payments you can afford, you can make a budget to see how your weekly and monthly expenses compare to your income. A home loan repayment calculator can help you here.

If you are a first-time homebuyer purchasing an existing home, you will likely be required to make a deposit that is 20% of the home’s value. That means that for a property worth $500,000, you will need a deposit of $100,000.

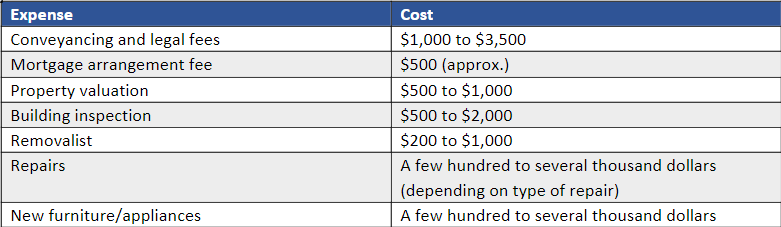

The hidden costs of buying a home in New Zealand

Buying property is not a straightforward process. There are several other costs that homebuyers must consider apart from home prices. Here is a list of expenses that homebuyers need to factor in when purchasing a home, according to consumer website MoneyHub.

The steps to buying a home in New Zealand

When considering buying a home in New Zealand, it is important to remember that there are several steps involved. While at first glance this may sound overwhelming, it is manageable if you know what is expected of you beforehand.

With this in mind, let’s take a quick look at the different steps:

- Research

- Set budget

- Get pre-approval

- Secure a property lawyer

- View homes

- Make offer

- Close

The first two steps on the list can be done well before you even start the process in earnest.

Now, let’s take a closer look at each of these steps so you will know how best to prepare.

1. Research

When it comes to purchasing property, the more you know, the better off you will be. The information you will want to gather at the start includes:

- The local market: You will want to research the housing market where you want to buy. This includes learning the average house price in the area, the average number of listings over a certain period, and how long homes stay on the market.

- Stay updated on the news: Real estate markets are notorious for fluctuating. Because the market can change on a dime, it is important that you stay up to date with the latest developments. This will help you make the most informed decision.

- Get advice: This can include getting advice on what to do at an open home or on which home loan to get. Online guides can help you here. As can real estate agents.

2. Set budget

After conducting your own research, you should have a better idea of asking prices for properties in the area you are looking at. Next, you can determine how much you need for a deposit. In New Zealand, mortgage lenders typically ask for a deposit of at least 20% of the purchase price.

Occasionally, lenders will accept a 10% deposit. Most homebuyers will draw up a budget, weigh up their income versus their regular expenses, and work out how much they need to save towards a deposit each month.

Note: a little further down in this article, we will outline existing government schemes for first-time homebuyers that will help you set the budget, if you qualify. Speaking of first-time home buyers, did you know that they are dominating the New Zealand property market?

3. Get pre-approval

Getting mortgage pre-approval means you know how much money you can borrow for a home loan.

There are several determining factors for pre-approval, including a registered valuation of the property you are looking at.

Another requirement is a copy of the signed sale and purchase agreement, after your offer has been accepted.

To get pre-approval, a lender will want to see your financial details, including:

- Income: pay slips, recent financial statements from your accountant (if self-employed)

- Expenses: to gauge your ability to meet loan repayments

- Debt: credit cards, overdraft, hire purchases, student loans, etc.

- Deposit: to prove you have enough saved for your deposit. This includes bank statements, details around KiwiSaver (if it is your first home), etc.

4. Secure a property lawyer

Finding a property purchase solicitor will ensure that you and your future seller meet all the legal obligations at each stage of the home-buying process. They can also thoroughly check important legal documents, including sale and purchase agreements, titles, and land information memorandums (LIMs).

Here are some ways to find a property lawyer:

- Ask friends and family

- Ask your mortgage lender or adviser

- Check with law societies like the New Zealand Law Society

Buying a home in New Zealand may take a few steps—you just need to know what to look out for.

5. View homes

You can start viewing properties either at open houses or by arranging private viewings with the seller’s estate agent.

When viewing homes, look for the following:

- Cracks in the walls: possible structural issues with the house, like movement in the foundations

- Floors: Sagging floors, especially near the bathroom, may indicate issues with plumbing

- Plumbing: Check water pressure, such as how long it takes for hot water to come from the taps

- Fresh paint: A random area with fresh paint may be an attempt to hide damage. If the entire house has been recently painted, this should be less of an issue

- Roof: Find out when the roof was installed and if it has been checked recently

Remember to ask plenty of questions and investigate hidden areas such as the basement or attic. It is also a good idea to get a builder’s report on the property.

6. Make offer

After finding the home you want, it is time to make an offer.

There are two types of offers. One is a conditional offer. This depends on several criteria being met, for instance the completion of a satisfactory builder’s report or arranging finance. If the conditional offer is accepted, the conditions must be met by a certain date.

The other type of offer is an unconditional offer. This means you simply agree to the terms set in the contract. If you have any concerns about going with an unconditional offer, check with your lawyer. If your unconditional offer is accepted, that means it is final. Neither the buyer nor the seller can back out.

There are ways you can purchase or make an offer on a house:

- Negotiating on an asking price

- Through tender

- Through private negotiations

- At an auction (or pre-auction agreement)

7. Close

At this point, you are ready to complete the purchase. This usually comes four to six weeks after your offer was accepted. It just depends on the date you and the seller agreed upon.

On settlement day, your solicitor will exchange information with the seller’s lawyer, including:

- Any remaining money

- Transfer documents

- Keys

First-time homebuyer benefits when purchasing a home in New Zealand

First-time homebuyers in New Zealand can take advantage of several government incentives to significantly cut the amount of funds they need to buy a property. However, buyers must also meet strict eligibility requirements to access these grants. Here’s an overview of the various government-sponsored benefits available for first home buyers.

First Home Grants (Home Start Grants)

First-time home buyers, or previous homeowners who have been making regular contributions to KiwiSaver for the past three to five years, may be eligible for a First Home Grant of up to $10,000. Home buyers can apply for the grant through Kāinga Ora - Homes and Communities.

To be eligible for a First Home Grant, the applicant must:

- Be at least 18 years old

- Have earned $95,000 or less before tax in the past 12 months for a single buyer

- Have earned $150,000 or less before tax in the past 12 months for two or more buyers

- Not currently own any property, excluding Māori land

- Have been contributing at least the minimum amount to KiwiSaver, or complying fund or exempt employer scheme, for at least three years

- Purchase a property that is within the regional house price caps

- Agree to live in the property for at least six months

- Provide evidence of at least a 5% deposit of the purchase price of the property

First Home Loans

With a First Home Loan, buyers only need a 5% deposit instead of the standard 20%. First Home Loans are issued by selected banks and other lenders, and underwritten by Kāinga Ora, allowing lenders to provide loans that would otherwise sit outside their lending standards. Below are the eligibility requirements:

- Income cap: Maximum yearly income of up to $95,000 (before tax) for a single person, or a combined maximum yearly income of $150,000 (before tax) for two or more people.

- Minimum deposit: Minimum 5% of the purchase price of the house.

- House price cap: The price of the house must be less than the regional house price cap.

Kāinga Whenua Loans

The Kāinga Whenua Loan Scheme is an initiative between Kāinga Ora and Kiwibank to help Māori achieve home ownership on their multiple-owned land.

The loans are available for both Māori land trusts and individuals with a right to occupy their multiple-owned Māori land. The requirements and application process vary, depending on the loan option.

Kiwibank approves and provides loans, and applicants need to meet their standard lending criteria and the Kāinga Whenua criteria. Kāinga Ora provides lenders’ mortgage insurance for the loan.

A Kāinga Whenua loan limits the house an applicant can build, purchase, or relocate to the land to at least 70sqm, on piles, and with reasonable road access. It must also be located on the mainland North or South islands.

Tenant Home Ownership grant

The Tenant Home Ownership grant is a government-sponsored grant of 10% of the purchase price of selected Kāinga Ora houses up to a maximum of $20,000.

The grant, however, is not available in areas where there is high demand for state houses, including Auckland, Wellington City, Christchurch, Hamilton, and Tauranga.

KiwiBuild

KiwiBuild is a New Zealand government programme that started in 2018 aimed at building 100,000 affordable homes for eligible first home buyers by 2028. To be eligible to buy a home, an applicant must:

- Be at least 18 years old

- Be a New Zealand citizen, permanent resident or a resident visa holder who is “ordinarily resident in New Zealand”

- Not currently own a home in New Zealand or overseas

- Have a pre-tax income from the previous 12 months of $120,000 or less for a single buyer or $180,000 or less combined for two (or more) buyers

- Must commit to live in the KiwiBuild home for a minimum one year for a studio or one bedroom home and three years for a home with two bedrooms or larger, before the home can be rented out or sold

KiwiBuild homes range from studio apartments to multi-bedroom townhouses and are sold at different stages of development. The price of a KiwiBuild home depends on its size and location. Price caps are used to determine the maximum price that a KiwiBuild home can be sold for.

More help in buying a home in New Zealand

To find out more about buying a home in New Zealand, get in touch with one of the mortgage professionals we highlight in our Best of Mortgage section. Here you will find the top performing mortgage professionals across New Zealand.

Did you find this information on buying a home in New Zealand useful? Let us know in the comment section below.