Product ranges and pricing have improved over the last year, our Advisers on Banks report reveals

Product ranges and pricing have improved over the last year, NZ Adviser's Advisers on Banks report shows.

The majority of advisers (65%) thought there had been an improvement to products but a significant proportion (35%) still thought the opposite.

Westpac was ranked highest for its product range, followed by BNZ and ASB in third. However, BNZ came top for product diversification opportunities and interest rates and ASB led the pack in credit policy.

Advisers were asked to rate the performance of the banks they had dealt with in the last 12 months against 11 criteria, ranging from turnaround times to product diversification opportunities, with the final rankings based on an average of these category scores. Download the full report to see which banks were ranked highest.

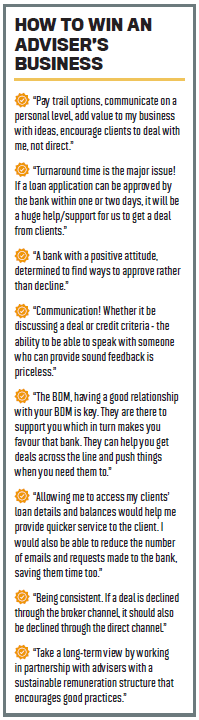

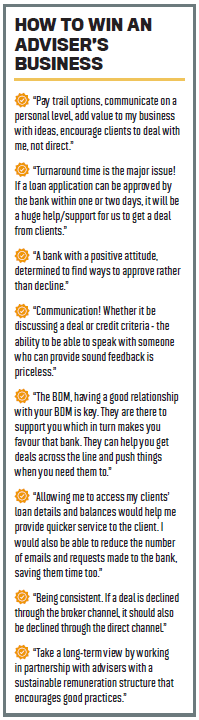

Interestingly product range sat more than half way down the list of what advisers said counted most to them, being trumped by the likes of turnaround times, interest rates and BDM support.

Some advisers hold product choice higher than others with one respondent saying the product suite was a vital factor in whether a bank would win their business. “Taking price and internal differences (BDMs for example) out of the equation, the lender with the most flexible and accommodating product suite will receive the most business.”

Westpac’s Choices Offset and ASB’s Orbit Facility were popular products among advisers. One respondent commented the Choices Offset product was an “easy way for clients to maintain and benefit from savings while also having a loan”. On the Orbit Facility product, an adviser said it, “allows clients to access redraw facility while ensuring the loan is repaid within the original term,” while another commented, “in line with internet banking is the best”.

You can read the full report here.

.png)

The majority of advisers (65%) thought there had been an improvement to products but a significant proportion (35%) still thought the opposite.

Westpac was ranked highest for its product range, followed by BNZ and ASB in third. However, BNZ came top for product diversification opportunities and interest rates and ASB led the pack in credit policy.

Advisers were asked to rate the performance of the banks they had dealt with in the last 12 months against 11 criteria, ranging from turnaround times to product diversification opportunities, with the final rankings based on an average of these category scores. Download the full report to see which banks were ranked highest.

Interestingly product range sat more than half way down the list of what advisers said counted most to them, being trumped by the likes of turnaround times, interest rates and BDM support.

Some advisers hold product choice higher than others with one respondent saying the product suite was a vital factor in whether a bank would win their business. “Taking price and internal differences (BDMs for example) out of the equation, the lender with the most flexible and accommodating product suite will receive the most business.”

Westpac’s Choices Offset and ASB’s Orbit Facility were popular products among advisers. One respondent commented the Choices Offset product was an “easy way for clients to maintain and benefit from savings while also having a loan”. On the Orbit Facility product, an adviser said it, “allows clients to access redraw facility while ensuring the loan is repaid within the original term,” while another commented, “in line with internet banking is the best”.

You can read the full report here.

.png)